what happens if you haven't filed taxes in 10 years canada

Web Failing to pay your taxes is not a crime but failing to file your tax returns is because its considered tax evasion. After that the IRS will assess the FTF penalty on your tax debt if you still havent filed.

I R S To Refund Late Filing Penalties For 2019 And 2020 Returns The New York Times

Because the states have more resources to pursue non-filers and delinquent taxpayers than the IRS does I generally recommend.

. The IRS estimates what it thinks. Failure to file or failure to pay tax could also be a crime. Web There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file.

Even if you request. And the penalties for tax evasion are harsh. Start with the 2018 one and then go back to 2009 and work your way back.

Then reach out to the CRA 1-888-863-8657 to find out what your options are. Also the IRS charges 3 interest on the amount you owe for every year. If you dont file your taxes the IRS will often file a Substitution for Return on your behalf.

For each return that is more than 60 days past its due date they will assess a 135. Web What happens if you havent filed taxes in 10 years in Canada. But when you do file a tax return the general.

Web File your tax returns on time even if you cant afford to pay taxes you owe. Web Surface Studio vs iMac Which Should You Pick. However if you do not file taxes the period of limitations on.

You will owe more than the. 5 Ways to Connect Wireless Headphones to TV. Web The extension will give you until around October 15th to file your return.

475 22 votes Theres No Time Limit on the Collection of Taxes. Web Will I get in trouble if I havent filed taxes in years. Penalties include up to one year in prison for each year you fail to file and fines of up to 25000 for each.

Web Where do I start if I havent filed taxes in years. Web There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. Web Luckily filing and paying your taxes is still possible even if you havent filed in a while.

There is generally a 10-year time limit on collecting taxes penalties and interest for each year. If you still refrain from paying the IRS obtains a legal claim to your property and assets lien and after that can even. Web Theoretically it could be 25 or 30 years later and the time limit will not have expired if you havent filed your return.

Because youre gonna pay a 5 penalty for late filing plus 1 interest per month on. You owe fees on the unpaid portion of your tax bill. Web If you dont file a tax return you will be in violation of the law.

The criminal penalties include up to one year in prison for each year you failed. Web Step 1 Check your status with the IRS. Web theres that failure to file and failure to pay penalty.

The IRS recognizes several crimes related to evading the assessment. Web If youre required to file a tax return and you dont file you will have committed a crime. Luckily filing and paying your taxes is still possible.

Web What happens if you dont pay taxes for multiple years. Web If you owed taxes for the years you havent filed the IRS has not forgotten.

Child Tax Credit 2021 2022 What To Do If You Didn T Receive Your Payment Last Year Marca

Video How To Amend Taxes That Are Already Filed Turbotax Tax Tips Videos

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How To File Us Tax Returns In Canada Ultimate Guide

How To Get Your 2022 New Mexico Tax Rebates

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

As Home Sale Prices Surge A Tax Bill May Follow The New York Times

What Happens If I Haven T Filed Taxes In Years H R Block

The Tax Deadline Is 10 Days Away Here S The Average Refund So Far

What Do Do If You Still Haven T Received Your Tax Refund Tom S Guide

What To Do If You Haven T Filed An Income Tax Return Moneysense

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

Moving Back To Canada A Resource Guide For Canadian Expatriates

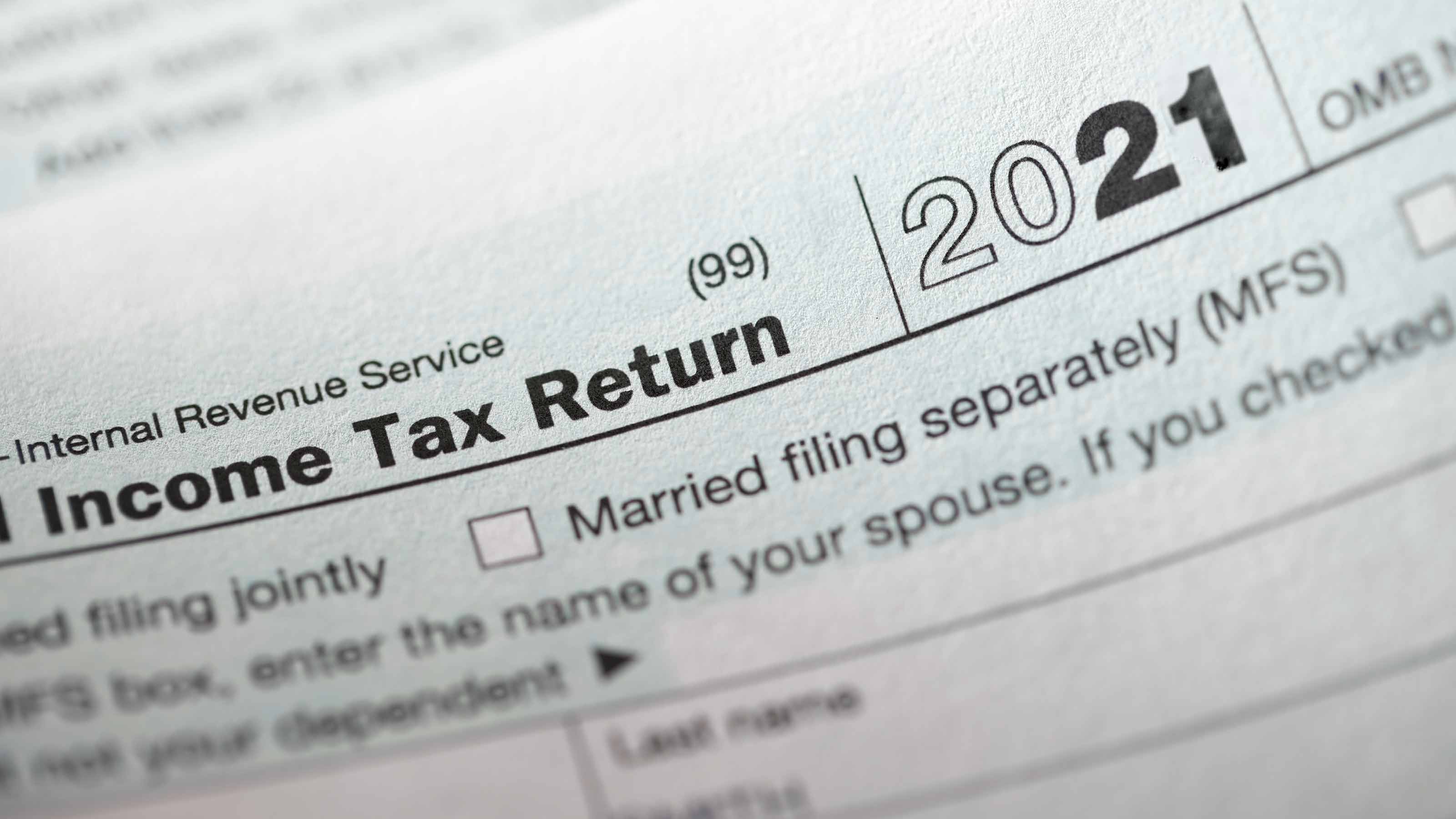

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Here S What Happens When You Don T File Taxes

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law Firm

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service